funding options

funding solutions for energy efficient organisations.

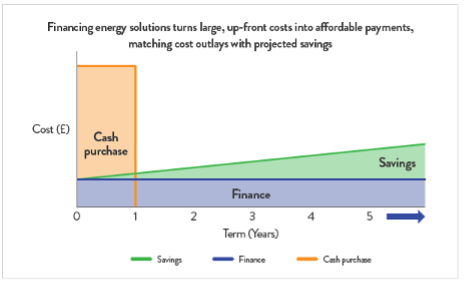

For many clients the need to manage capital expenditure is greater than ever. A funded solution can therefore provide clients the opportunity to direct capital into key investment areas whilst still achieving significant operational resilience and cost reduction benefits.

Energy Efficient Solutions Group (EESG) have partnered with Energy Finance specialists, Capitas, to offer an array of financial solutions including zero capital investment. Solar PV, LED & EV Charging Projects can be financed either on or off-balance sheet with all installation & build phase financing also included.

Table | Hire Purchase | Energy as a Service |

Definition | Traditional financing arrangement whereby the Customer pays for the technology in instalments and takes eventual ownership of the equipment at the end of an agreed fixed term. | A ‘pay for outcome’ model, with EESG guaranteeing an agreed level of technology availability over the contract term in return for unitary service payments. |

Applicable for | Projects of all sizes, private sector businesses | Usually larger or multi-site projects, public and private sector entities |

Maintenance & Monitoring | Finance payments are collected by the Funding Bank. Any Maintenance or Monitoring contracts are handled separately with EESG. | A full turnkey solution. Ongoing monitoring, maintenance, reporting and spare/replacement part costs are included in the service payments. |

Balance Sheet Treatment | On balance sheet | Contract has performance-related elements and can be treated as ‘off balance sheet’*. |

Best Option for | Customers who want to obtain ownership of the equipment at the end of the finance term and enjoy potential tax benefits* | Customers desiring a fully-inclusive service option delivering peace of mind, on a structure which can be deemed ‘off balance sheet’* |

*subject to the discretion of the Customer’s auditors. EESG and Capitas Finance do not provide accounting, tax or legal advice to Customers.

Benefits of finance

-

Cashflow & working capital improvement

-

Extension and retention of existing credit lines

-

Flexibility of ownership

-

Ability to focus existing capital on core business investments

-

Payments can be aligned with anticipated savings/revenues generated by the equipment.

-

Tax relief on applicable products – Schemes such as ‘Annual Investment Allowance’ and ‘Full Expensing’ (formerly ‘Super Deduction’), offer customers to chance receive up to 25% of the value of the project back in relief on corporation tax in the first year after installation. This is for qualifying technology and Hire Purchase agreements only – speak to your accountants for more information.